Clark Wealth Partners - Questions

Fascination About Clark Wealth Partners

Table of ContentsGetting My Clark Wealth Partners To WorkClark Wealth Partners for BeginnersSee This Report about Clark Wealth PartnersClark Wealth Partners Things To Know Before You Get This8 Easy Facts About Clark Wealth Partners DescribedThe Ultimate Guide To Clark Wealth PartnersThe Main Principles Of Clark Wealth Partners

These are experts that offer investment guidance and are registered with the SEC or their state's safeties regulatory authority. Financial consultants can likewise specialize, such as in pupil loans, senior demands, taxes, insurance and various other elements of your finances.Not constantly. Fiduciaries are legitimately needed to act in their client's benefits and to maintain their cash and property different from other possessions they manage. Only financial consultants whose designation needs a fiduciary dutylike licensed monetary planners, for instancecan state the exact same. This difference also suggests that fiduciary and financial expert fee frameworks vary as well.

Not known Facts About Clark Wealth Partners

If they are fee-only, they're more probable to be a fiduciary. If they're commission-only or fee-based (implying they're paid by means of a combination of fees and payments), they might not be. Numerous qualifications and designations require a fiduciary duty. You can inspect to see if the professional is registered with the SEC.

:max_bytes(150000):strip_icc()/what-will-a-good-financial-planner-do-for-me-2388442_color2-566eaab6a87b463d951130f508b5aa3e.png)

Selecting a fiduciary will guarantee you aren't steered toward particular investments due to the compensation they provide - retirement planning scott afb il. With whole lots of cash on the line, you may want a financial professional that is legitimately bound to make use of those funds meticulously and just in your best interests. Non-fiduciaries might suggest investment items that are best for their pocketbooks and not your investing goals

The 20-Second Trick For Clark Wealth Partners

Check out more currently on just how to keep your life and financial savings in balance. Increase in financial savings the average house saw that dealt with a financial expert for 15 years or more contrasted to a similar house without a monetary expert. Source: Claude Montmarquette & Alexandre Prud'homme, 2020. "A lot more on the Value of Financial Advisors," CIRANO Project News 2020rp-04, CIRANO.

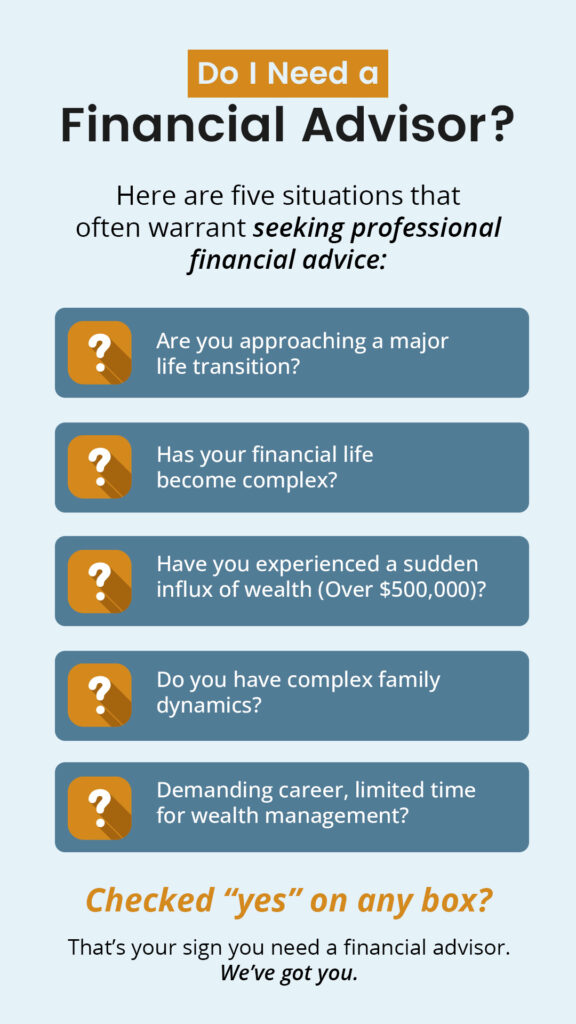

Financial advice can be helpful at turning factors in your life. When you satisfy with a consultant for the first time, work out what you want to obtain from the suggestions.

Everything about Clark Wealth Partners

As soon as More Help you have actually accepted go ahead, your financial adviser will prepare a financial plan for you. This is provided to you at one more meeting in a document called a Declaration of Guidance (SOA). Ask the advisor to discuss anything you don't understand. You ought to always feel comfortable with your consultant and their advice.

Urge that you are informed of all deals, which you obtain all communication pertaining to the account. Your advisor may recommend a handled discretionary account (MDA) as a method of handling your investments. This entails signing an arrangement (MDA contract) so they can buy or market financial investments without having to consult you.

Some Known Details About Clark Wealth Partners

To protect your cash: Do not give your advisor power of attorney. Insist all communication about your investments are sent out to you, not simply your adviser.

If you're relocating to a brand-new adviser, you'll require to prepare to move your financial documents to them. If you need aid, ask your adviser to discuss the procedure.

To load their footwear, the nation will require more than 100,000 brand-new financial consultants to go into the industry.

The 10-Minute Rule for Clark Wealth Partners

Aiding people attain their monetary objectives is a monetary consultant's main feature. But they are likewise a local business owner, and a portion of their time is dedicated to handling their branch office. As the leader of their method, Edward Jones financial advisors require the management skills to hire and handle staff, along with business acumen to produce and perform a company method.

Financial experts spend some time each day watching or reading market information on tv, online, or in trade publications. Financial advisors with Edward Jones have the advantage of home office research teams that help them stay up to day on supply referrals, shared fund administration, and a lot more. Investing is not a "set it and forget it" activity.

Financial consultants must arrange time every week to meet new people and capture up with the individuals in their round. The monetary services sector is heavily regulated, and laws transform frequently - https://peatix.com/user/28420248/view. Lots of independent economic consultants spend one to two hours a day on compliance activities. Edward Jones monetary advisors are privileged the home workplace does the hefty lifting for them.

Clark Wealth Partners - Questions

Edward Jones monetary advisors are encouraged to go after added training to broaden their expertise and abilities. It's additionally a great concept for monetary consultants to attend industry meetings.